Mutual Funds

Mutual Funds- A mutual fund is a financial vehicle that invests in securities such as stocks, bonds, money market instruments, and other assets by pooling money from multiple participants. Professional money managers manage mutual funds, allocating assets and attempting to generate capital gains or income for the fund’s investors. The mutual fund portfolio is constructed and managed to meet the investment objectives indicated in the prospectus.

Mutual funds provide access to professionally managed portfolios of stocks, bonds, and other assets to small and individual investors. As a result, each stakeholder shares in the fund’s gains and losses proportionately. Mutual funds invest in a wide range of assets. Their success is often measured by the change in the fund’s total market capitalization, which is calculated by combining the performance of the underlying investments.

Mutual Funds: An Overview

Mutual funds combine money from investors and purchase other securities, most often stocks and bonds. The mutual fund company’s worth is determined by the performance of the securities it buys. As a result, when you purchase a mutual fund unit or share, you accept the portfolio’s performance or, more accurately, a portion of the portfolio’s value. Investing in a mutual fund is not the same as investing in individual stocks. Unlike stock, mutual fund shares do not provide voting rights to their owners. Instead of a single holding, a mutual fund share reflects investments in various stocks (or other securities).

Because of this, the price of a mutual fund share is referred to as the net asset value (NAV) per share or NAVPS. The NAV of a fund is calculated by dividing the entire value of the portfolio’s securities by the total number of shares outstanding. All shareholders, institutional investors, and business executives or insiders possess outstanding shares. Mutual fund shares are generally acquired or redeemed at the fund’s current NAV, which does not vary during market hours but is settled after each trading day, unlike a stock price. As a result, when the NAVPS is resolved, the price of a mutual fund is likewise changed.

The typical mutual fund owns over a hundred different securities, allowing shareholders to benefit from significant diversification at a reasonable cost. Consider the case of a shareholder who buys Google shares solely before the business suffers a poor quarter. Because all of his dollars are connected to one firm, he stands to lose a lot of money. On the other hand, a separate investor may purchase shares of a mutual fund that owns Google stock. Because Google represents such a small percentage of the fund’s portfolio, it loses far less when it has a terrible quarter.

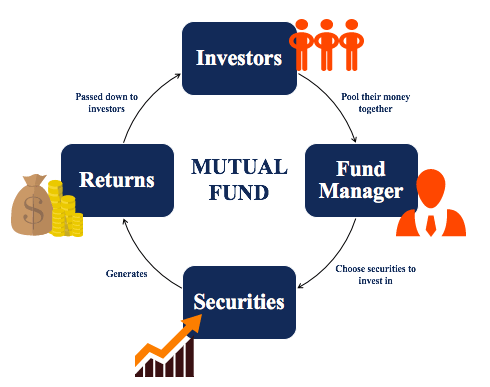

Mutual Fund Work

A mutual fund is both a financial investment and a legal entity. This dual nature may appear odd, but it is different from how an AAPL share represents Apple Inc. When an investor buys Apple shares, he is purchasing a portion of the company’s equity and assets. On the other hand, a mutual fund investor purchases a part of the mutual fund business and its assets. The distinction is that Apple makes revolutionary products and tablets, whereas a mutual fund company makes investments.

A mutual fund generally provides three types of returns to investors:

- The fund’s portfolio provides income, dividends on stocks, and interest on bonds. Distribution is when a fund pays out virtually all of the money it earns over a year to its shareholders. Investors are frequently given the option of receiving a cheque for dividends or reinvesting the gains to get new shares.

- The fund will earn a capital gain if it sells securities that have grown in value. Most funds also distribute these gains to their investors.

- When the value of a fund’s holdings rises but the fund manager does not sell them, the value of the fund’s shares rises as well. You may then sell your mutual fund shares on the market for a profit.

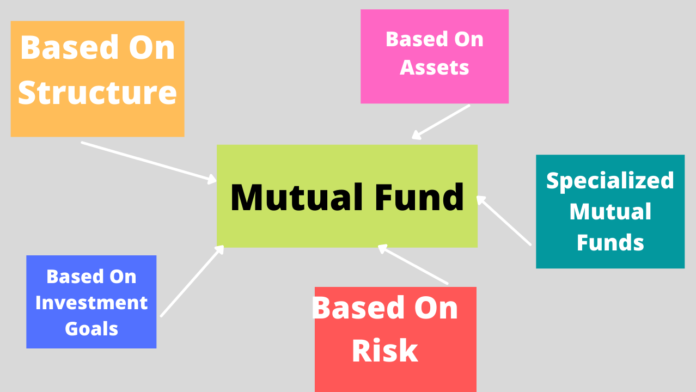

Types Of Mutual Funds

Based On Assets

1. Equity Funds

Because equity funds typically invest in equities, they are also known as stock funds. They support the money raised from various investors with various backgrounds in different firms’ shares/stocks. The profits and losses connected with these funds are entirely determined by how the invested shares perform in the stock market (price increases or decreases). Furthermore, over time, equity funds have the potential to create enormous profits. As a result, the risk associated with these funds is often higher.

2. Debt Funds

Debt funds typically invest in fixed-income instruments, including bonds, stocks, and Treasury bills. They invest in Fixed Maturity Plans (FMPs), Gilt Funds, Liquid Funds, Short-Term Plans, Long-Term Bonds, and Monthly Income Plans, among other fixed-income instruments. Because the investments have a set interest rate and maturity date, they might be suitable for passive investors looking for consistent income (interest and capital gain) with little risk.

3. Money Market Funds

The stock market is where investors buy and sell equities. Investors can also invest in the money market, sometimes known as the capital market or cash market. The government manages it in collaboration with banks, financial institutions, and other businesses by issuing money market instruments such as bonds, T-bills, dated securities, and certificates of deposit. The fund manager invests your money and pays you dividends regularly. Choosing a short-term strategy (no more than 13 months) can significantly reduce the danger of investing in such funds.

4. Hybrid Investment Funds

Hybrid funds (Balanced Funds), as the name implies, are an optimal combination of bonds and stocks, spanning the gap between equity and debt funds. The ratio might be either fixed or variable. In a nutshell, it combines the best features of two mutual funds by allocating 60% of assets to stocks and 40% to bonds, or vice versa. Hybrid funds are appropriate for investors who choose to assume higher risks in exchange for the advantage of “debt plus returns” rather than sticking to lower but more consistent income schemes.

Based On Structure

Different characteristics are also used to categorize mutual funds (like risk profile, asset class, etc.). The structural categorization – open-ended funds, closed-ended funds, and interval funds – is pretty broad, and the main distinction is the ability to buy and sell individual mutual fund units.

1. Open-Ended Funds (OEFs)

There are no restrictions on open-ended funds, such as a time limit or the number of units that can be traded. These funds allow investors to swap funds whenever they want and leave when they need to at the current NAV (Net Asset Value). It is the only reason the unit capital fluctuates when new entries and departures occur. If an open-ended fund does not wish to accept new investors, it might opt to discontinue doing so (or cannot manage significant funds).

2. Closed-Ended Funds (CEFs)

The unit capital to invest in closed-ended funds is pre-determined. The fund firm is not allowed to sell more than the agreed-upon amount of units. Some funds have a New Fund Offer (NFO) period, during which you must purchase units by a specific date. NFOs have a pre-determined maturity period, and fund managers can choose any fund size. As a result, SEBI has required that investors have the option of repurchasing the funds or listing them on public markets to exit the schemes.

3. Interval Investment Funds

Interval funds feature both open-ended and closed-ended characteristics. These funds are only available for acquisition or redemption at certain times (determined by the fund house) and are otherwise closed. In addition, for at least two years, no transactions will be authorized. These funds are best for investors who want to put aside a large quantity of money for a short-term financial objective, such as a 3-12 months vacation.

Based On Investment Goals

1. Growth Mutual Funds

Growth funds often invest a significant percentage of their assets in stocks and growth sectors, making them ideal for investors (mainly Millennials) with extra cash to put in riskier (but potentially higher-returning) plans or who are enthusiastic about the scheme.

2. Income Mutual Funds

Income funds are a type of mutual debt fund that invests in various assets such as bonds, certificates of deposit, and securities. Income funds have historically earned investors higher returns than deposits, thanks to experienced fund managers who keep the portfolio in sync with rate changes without jeopardizing the portfolio’s trustworthiness. They’re excellent for risk-averse investors with a time horizon of two to three years.

3. Liquid Investment Funds

Liquid funds, like income funds, are debt funds since they invest in debt instruments and money market funds with a term of up to 91 days. The highest amount that may be invested is Rs 10 lakh. The way liquid funds compute their Net Asset Value is a distinguishing feature that sets them apart from other debt funds. The NAV of liquid funds is calculated for 365 days (including Sundays), whereas the NAV of additional funds is calculated for just business days.

4. Tax-Avoidance Accounts

Over time, ELSS, or Equity Linked Savings Schemes, have risen in popularity among investors. They not only help you to maximize your wealth while saving money on taxes, but they also have the shortest lock-in period of only three years. They are known to provide non-taxed returns in the 14-16 percent region by investing primarily in equities (and associated products). These funds are best suited for salaried individuals looking to invest long-term.

5. Aggressive Growth Funds

The Aggressive Growth Fund, which is slightly riskier when investing, is meant to produce large monetary profits. Despite being vulnerable to market volatility, one might choose a fund based on its beta (a measurement of the fund’s movement about the market). For instance, if the market has a beta of 1, an aggressive growth fund will have a beta of 1.10 or higher.

6. Capital Protection Funds

If the goal is to protect your money, Capital Protection Funds can help you achieve that goal while generating lower returns (12 percent at best). A part of the money is put into bonds or CDs, while the remainder is put into stocks by the fund management. Though the risk of losing money is low, it is recommended that you stay invested for at least three years (closed-ended) to protect your money, and the returns are taxed.

7. Funds with a Fixed Maturity

Many investors choose to invest at the end of the fiscal year to take advantage of triple indexation and lower their tax burden. Fixed Maturity Plans (FMP) – which invest in bonds, securities, money market, and other assets – are a fantastic option if you’re concerned about debt market trends and dangers. FMP operates on a defined maturity time, ranging from one month to five years, as a closed-ended plan (like FDs). The fund management guarantees that the money is invested for the same amount of time to earn accrued interest when the FMP matures.

8. Pension Funds

Most scenarios (such as a medical emergency or a child’s wedding) may be covered by putting a percentage of your salary into a chosen pension fund over a lengthy period to ensure your and your family’s financial security after retiring from a regular job. Savings (no matter how large) do not last forever, so relying exclusively on them to carry you through your elderly years is not advised. EPF is one example, but there are other profitable schemes offered by banks, insurance companies, and other financial institutions.

Based On Risk

1. Very-Low Risk Funds

Liquid funds and ultra-short-term funds (one month to one year) are recognized for minimal risk. Thus their returns are expected to be modest (6 percent at best). Investors select this to achieve their short-term financial goals while keeping their money secure.

2. Low-Risk Funds

Investors are hesitant to engage in riskier funds in the case of rupee devaluation or an unanticipated national catastrophe. In such circumstances, fund managers advocate investing in a liquid, ultra-short-term, arbitrage fund or a mix of these funds. Returns may range from 6 to 8%, but investors have the option to swap when values become more solid.

3. Medium-Risk Funds

Because the fund manager invests a portion in debt and the balance in equity funds, the risk element is moderate. The NAV is not particularly volatile, and typical returns of 9-12 percent are possible.

4. High-Risk Funds

High-risk mutual funds require active fund management and are suitable for investors with no risk aversion and looking for significant returns in interest and dividends. Because performance reviews are vulnerable to market volatility, they must be conducted regularly. You may expect a 15% return on your investment, while most high-risk funds provide up to 20% returns.

Specialized Mutual Funds

1. Sector Funds

Theme-based mutual funds invest only in a single industry area. The risk factor is higher because these funds exclusively invest in a few firms in certain areas. It’s a good idea for investors to watch the numerous sector-related developments. Sector funds are also quite profitable. Some industries, such as banking, IT, and pharmaceuticals, have had a rapid and steady growth in recent years and are expected to continue doing so.

2. Index Funds

Index funds are excellent for passive investors since they invest in an index. A fund manager does not manage it. An index fund discovers stocks and their associated market index ratios, then invests in similar equities in a similar proportion. Even if they cannot outperform the market (which is why they are not well-liked in India), they play it safe by imitating the index’s performance.

3. Fund of Mutual Funds

A diversified mutual fund investment portfolio provides a host of advantages, and ‘Funds of Funds,’ also known as multi-manager mutual funds, are designed to take advantage of this by investing in various fund categories. In summary, choosing one fund that invests in multiple funds rather than multiple funds provides diversification while also lowering costs.

4. Emerging Markets Funds

Investing in developing economies is considered a high-risk gamble with a history of negative returns. India is a vibrant and growing economy where domestic stock market investors may make significant profits. They, like other markets, are subject to market volatility. Developing economies are anticipated to account for the vast bulk of global growth in the following decades in the long run.

5. Foreign/International Funds

Foreign mutual funds, which are popular among investors wanting to diversify their portfolios beyond India, may provide high returns even when the Indian stock markets perform well. A hybrid method (say, 60% domestic equities and 40% overseas funds) or a feeder approach (getting local funds to invest in international companies), or a theme-based allocation can all be used by an investor (e.g., gold mining).

6. Global Funds

Apart from the identical linguistic sense, global and international funds are not the same. While a worldwide fund primarily invests in global markets, it may also invest in your local nation. The International Funds are mainly focused on international calls. With their diverse and worldwide approach, global funds can be highly hazardous due to different policies and market and currency fluctuations; however, they can serve as a hedge against inflation, and long-term returns have traditionally been good.

7. Real Estate Funds

Despite India’s real estate growth, many investors are still afraid to engage in such projects because of the numerous dangers. The investor will be an indirect participant in a real estate fund because their money will be invested in existing real estate companies/trusts rather than projects. When it comes to acquiring a home, a long-term investment eliminates dangers and legal difficulties while also providing some liquidity.

8. Commodity-Focused Stock Funds

These funds are suited for individuals with a high-risk tolerance and who want to diversify their holdings. Commodity-focused stock funds allow you to try your hand at various transactions. On the other hand, returns are not always predictable and depend on the stock company’s or the commodity’s performance. In India, gold is the only commodity that mutual funds may invest indirectly. The rest buy commodity enterprises’ fund units or shares.

9. Market Neutral Funds

Market-neutral funds are ideal for individuals who want to insulate themselves from unfavorable market trends while still earning a respectable return (like a hedge fund). These funds offer strong returns due to their greater risk-adaptability, allowing even modest investors to outperform the market without exceeding their portfolio restrictions.

10. Leveraged/inverse funds

An inverse index fund’s returns move in the opposite direction of the benchmark index, whereas a standard index fund’s returns move in the same direction as the benchmark index. It’s just selling your shares when the stock price falls, then repurchasing them at a lower price (to hold until the price goes up again).

11. Asset Allocation Funds

This fund is highly versatile, combining debt, equity, and even gold in an optimal ratio. Asset allocation funds can govern the equity-debt distribution based on a pre-determined formula or the fund manager’s judgments on current market patterns. It’s similar to hybrid funds, but it necessitates a high level of competence from the fund management in terms of the bond and stock selection and allocation.

12. Exchange-Traded Funds (ETFs)

It is a type of index fund that may be purchased and traded on exchanges. Exchange-traded Funds have opened up a whole new universe of investment opportunities for investors, allowing them to get broad exposure to stock markets throughout the world and specialized sectors. An ETF is a type of mutual fund that may be exchanged in real-time at a price that fluctuates throughout the day.

Buy And Sell Mutual Funds

Rather than buying from other investors, investors purchase mutual fund shares directly from the fund or through a fund broker. The fund’s per-share net asset value plus any fees imposed at the purchase, such as sales loads, is the price that investors pay for the mutual fund.

Shares in mutual funds are “redeemable,” which means that investors can sell them back to the fund. In most cases, the fund is required to deliver you the money within seven days.

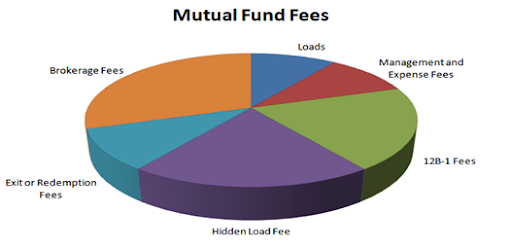

Mutual Fund Fees

A mutual fund, like any other business, has expenses. Fees and expenditures are used by funds to pass on these costs to investors. Prices differ from one fund to the next. To earn the same returns for you, a high-cost fund must outperform a low-cost fund.

Even little variations in fees might result in significant profits over time. For example, if you put $10,000 into a fund with a 10% annual return and 1.5 percent yearly operating expenditures, you’d end up with $49725 after 20 years. After 20 years, if you invested in a fund with the same return and fees of 0.5 percent, you would have $60,858.

Using a mutual fund cost calculator to calculate how the fees of different mutual funds pile up over time and eat into your returns takes only minutes. Fee kinds can be found in the Mutual Fund Glossary.

Advantages And Disadvantages Of Mutual Funds

Advantages

- Liquidity

- Diversification

- Investment needs are minimal.

- Management by professionals

- A wide range of options is available.

Disadvantages

- Fees, commissions, and other costs are high.

- Portfolios with a lot of cash

- There is no FDIC insurance.

- Comparing funds is difficult.

- Holdings lack transparency.

Mutual Fund

Thank you very much for reading this article. If you need any information related to this article, you can tell us through the comment box. Do share this article with your friends or relatives. Thanks once again.

What is Mutual Fund?

A mutual fund is a financial vehicle that invests in securities such as stocks, bonds, money market instruments, and other assets by pooling money from multiple participants.

Explain the function of a Mutual Fund?

A mutual fund is both a financial investment and a legal entity. This dual nature may appear odd, but it is different from how an AAPL share represents Apple Inc. When an investor buys Apple shares, he is purchasing a portion of the company’s equity and assets.

Tell me the mutual fund fees?

A mutual fund, like any other business, has expenses. Fees and expenditures are used by funds to pass on these costs to investors. Prices differ from one fund to the next. To earn the same returns for you, a high-cost fund must outperform a low-cost fund.

Explain the advantages of Mutual Fund?

Liquidity Diversification Investment needs are minimal. Management by professionals A wide range of options is available.

Explain the disadvantages of Mutual Fund?

Fees, commissions, and other costs are high. Portfolios with a lot of cash

There is no FDIC insurance. Comparing funds is difficult. Holdings lack transparency.

What are the types of Mutual Funds?

Based On Structure

Based On Assets

Based On Investment Goals

Based On Risk

Specialized Mutual Funds

To know more about it, you can see the above article.