Debt Free Companies

Debt financing refers to money borrowed by a company to run its operations, as opposed to equity financing, which involves raising funds from investors in exchange for a share of the firm’s revenues. Consider this: based on the type of loan a company is seeking, it may be categorised into two major categories: short-term debt and long-term debt.

Debt financing is a time-limited activity in which the borrower is required to repay the borrowed amount plus interest within the agreed-upon time frame.

As a business expense, the cost of debt (interest) is entirely deductible. Debt, on the other hand, introduces some rigidity to the balance sheet by imposing a predetermined repayment timeline.

For example, if a corporation with a large amount of debt on its books faces a struggle in its operation, it may find it difficult to remain profitable. Even if the company is able to save money elsewhere, it may still struggle with high fixed debt costs.

What is Net Debt

In the abstract, looking at the debt amount provides virtually nothing about the entire leverage situation. As a result, it is usually advisable to take a comprehensive look at a company’s debt. This is when net debt enters the picture.

The ability of a corporation to pay its debt if it is due today is measured by net debt.

The debt that remains after paying off as much debt as possible with liquid assets is referred to as net debt. Simply put, it is the sum of short- and long-term borrowings minus cash and cash equivalents. So, if a corporation owes Rs 150 and has Rs100 in cash, the net debt is Rs 50.

The “net” prefix before “debt” is critical in this case. When a corporation declares that it is “net debt-free,” it does not mean that it has paid off all of its debts. Until the debt is completely paid off, it remains on the books. It is possible for a firm to be debt-free without paying down debt.

Debt Free Companies- Large Cap Stocks

1. ITC Limited

ITC Limited, headquartered in Kolkata, West Bengal, is one of India’s largest multinational enterprises. Its market value is currently around Rs 2.5 lakh crore, with gross sales of Rs 456 billion (as of 31 March 2020). Cigarettes, FMCG, Agri-Business, Hotels, and Paper & Packaging are among areas where ITC has a foothold.

ITC is primarily reliant on its cigarette industry, but it has been able to diversify in terms of sales in the last ten years, with cigarettes accounting for about 40% of total revenues.

However, the tobacco industry’ contribution to ITC’s profitability continues to be a major element dragging the stock down (due to ESG considerations).

ITC’s stock price has plummeted since the company’s third-quarter results in the previous fiscal year. In the last six years, the company has been the worst performer among large-cap consumer companies.

(10- Year Performance of ITC)

2. Hindustan Uniliver Limited (HUL)

With over 80 years of experience, HUL is one of India’s largest fast-moving consumer products companies. The brand has been so ingrained in the Indian mindset that more than nine out of ten Indian families utilise one or more of the company’s products. HUL is in a unique situation as a result of this.

Surf Excel, Lux, Lifebuoy, Dove, Fair & Lovely, Rin, Wheel, Vaseline, Sunsilk, Axe, Lakme, Pepsodent, Closeup, Brooke Bond, Kwality Wall’s, Knorr, Pond’s Clinic Plus, Lipton, Kissan, and others are among HUL’s brands. HUL has acquired trademarks such as Boost and Horlicks, among others, following its merger with GlaxoSmithKline Consumer Healthcare Limited.

(10-Year Performance of Hindustan Unilever)

Home Care, Beauty & Personal Care, Foods & Refreshments, and Others are the three main segments in which HUL works.

The graph below shows the revenue breakdown by segment for FY20.

3. Relince Industries ( Debt Free Companies)

Reliance Industries remains India’s largest corporation (M-cap wise). Its numerous competitors actively monitor the company’s financial results, as modest decisions made by the corporation have a significant impact on the whole industry in which it works.

While petrochemicals and refining continue to dominate the top and bottom lines, digital services are beginning to play a larger role in the bottom line, with the business placing a large bet on Jio to lead India’s digital transformation.

After being debt-free, the corporation now has the financial resources to wreak havoc on its telecommunications competitors.

Given the corporation’s heavy investment in technology, the revenue and profit mix of the company is likely to change dramatically over the next decade.

Reliance’s goal to level its massive user base and offer financial solutions is now a separate operating sector for the company, emphasising the company’s plan to offer an unparalleled mix of financial and digital services.

The company has been debt-free thanks to a series of investments from diverse investors.

The company’s net debt was Rs 1.61 lakh crores at the end of March 2020. (outstanding debt of Rs 3.36 lakh crore minus cash and cash equivalents of Rs 1.75 lakh crores). The company is now debt-free after raising Rs 1.69 lakh crore (Rs 53,000 crore from the rights sale and Rs 1.16 lakh crore from Jio transactions).

Reliance Industries’ market value is now Rs 12.76 trillion.

(10-Year Performance of Relince Industries)

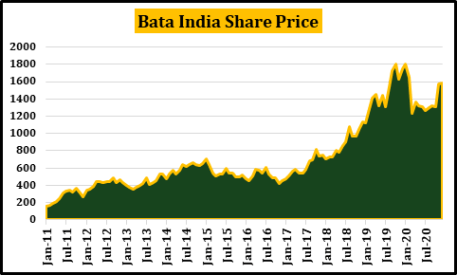

4. Bata India

Bata India Limited, which was founded in 1931, is the country’s largest footwear manufacturer and retailer. They manufacture a wide range of footwear at four strategically located, cutting-edge manufacturing sites across the country.

With over a thousand outlets across India, including franchisee stores, the company has a significant pan-India retail presence.

(10-Year Performance of Bata India)

Over the last few years, the company’s revenue has increased significantly. The company’s market capitalization is currently Rs 203.32 billion, with a debt-to-equity ratio of 0.

5. Whirlpool of India Ltd.

Whirlpool of India is debt-free, with cash and cash equivalent of Rs 1948.53 crore as of September 30, 2020, up from Rs 1284 crore as of March 31, 2020.

It is a major producer and distributor of electronic equipment such as washing machines and refrigerators. Microwave ovens, air conditioners, built-in and small appliances are among the products it manufactures and sells to both foreign and domestic markets.

(10-Year Performance of Whirlpool of India Ltd.)

Increased competition in the refrigerator category, which has been the company’s main source of growth, has put pressure on the company.

Whirlpool’s washing machine, room air conditioner, and service income have all grown at a slower pace.

Debt Free Companies- Small-Cap Stocks

6. Persistent System

Persistent Systems is a global solutions provider that helps businesses across industries and geographies modernize and accelerate their digital businesses.

Working with numerous prominent cloud firms as partners, the company is focused on creating a unique combination of powerful cloud-based applications, platforms, and tools for clients.

The business provides a full product life cycle management service. It is a multinational company with a focus on software products, services, and technological innovation.

The company’s market capitalization now stands at Rs 11,115 crores.

(10-Year Performance of Persistent Systems )

Debt-Free Companies Screener- Some more examples

| Company Name |

|---|

| Nestle India Asian Paints Maruti Suzuki Infosys HCL Technologies Ltd. Tata Consumer Product Ltd. |

High-Debt Companies in India

The most appealing aspect of debt financing is that the lenders do not take a stake in the company. Although there are certain restrictions written into the loan paperwork known as covenants, the ownership pattern remains the same and the lender has no control over the business’s operations.

It’s important to remember when evaluating firms for investment purposes that just because a company is debt-free doesn’t mean it’s a good investment. A quick peek at the top debt-free corporations listed above reveals that they are not all the most sought-after businesses.

Debt is an important tool in the process of achieving growth and taking advantage of available chances. Rather than seeking debt-free companies, the goal is to look for organizations that maintain an appropriate balance between growth and debt.

Debt Free Companies

Thank you very much for reading this article. If you need any information related to this article, you can tell us through the comment box. Do share this article with your friends or relatives. Thanks once again.

What are the Debt-Free Companies?

Debt financing refers to money borrowed by a company to run its operations, as opposed to equity financing, which involves raising funds from investors in exchange for a share of the firm’s revenues. Consider this: based on the type of loan a company is seeking, it may be categorized into two major categories: short-term debt and long-term debt.

What is net debt?

The debt that remains after paying off as much debt as possible with liquid assets is referred to as net debt. Simply put, it is the sum of short- and long-term borrowings minus cash and cash equivalents.

What huge companies are debt-free?

FITB $2.9 billion 52%

SRG $1.66 billion 6.3%

GRMN $1.45 billion -1.8%.

Are there any companies that are debt-free?

In the Standard & Poor’s 500, there are 11 corporations that have no long-term debt. According to an Investor’s Business Daily study of data from S&P Global Markets Intelligence, this is true through the most recent quarter.

Is Apple a debt-free organization?

Apple has a net debt-to-EBITDA ratio of just 0.50, indicating that it may easily increase leverage. Moreover, despite having net debt, it received more interest than it had to pay in the previous twelve months. So there’s little doubt that this business can take on debt while remaining as calm as a cucumber.